AI Chatbots in the Banking Industry: Benefits with Real-world Examples

The banking world has changed significantly over the years, thanks to technology. ATMs, e-banking, mobile banking apps, automation in back-end operations, etc., have all improved customer experience and employee efficiency. So, why should AI Chatbots for banks be any different? Chatbots are not here to replace human customer support agents. In fact, they complement each other. Chatbots efficiently handle routine queries and provide 24/7 support, whereas humans utilize problem-solving skills and empathy to handle complex, nuanced situations. By combining their strengths, banks can create a service experience that’s both efficient and personal. They can build custom chatbots that align with their unique workflows and work alongside human agents to enhance customer experiences by leveraging Artificial Intelligence effectively. This blog will explore AI chatbots and human agents in banking customer service and discuss why combining them makes sense.

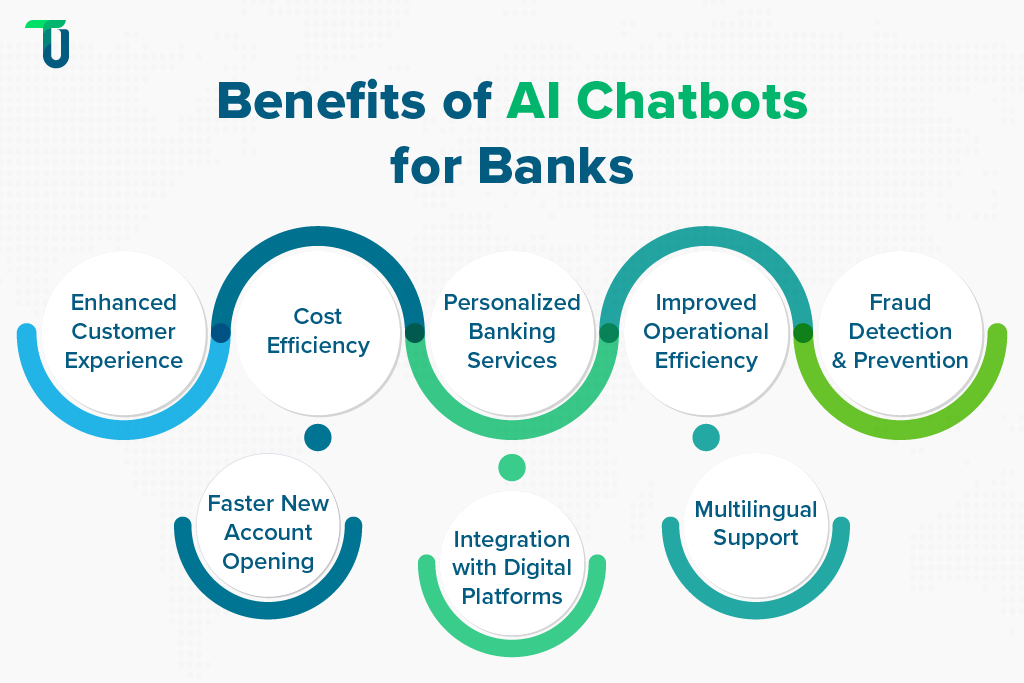

Major banks have long employed Virtual Agents to interact with customers and streamline operations. Let’s discuss the key advantages AI chatbots provide along with some real-world examples of banks:

Enhanced Customer Experience:AI chatbots provide 24/7 banking support, responding instantly to customer queries, reducing wait times, and improving satisfaction.

Bank of America’s Erica assists millions of users with tasks, like checking account balances, tracking spending, and even providing financial advice. Its ability to handle complex queries in real-time has taken customer experience to the next level.

Cost Efficiency: By automating routine tasks, AI chatbots significantly reduce the need for human intervention, lowering operational costs for banks. They can simultaneously handle thousands of inquiries and free up human agents to focus on more complex issues.

Ally Assist, Ally Bank’s virtual assistant, handles a high volume of customer inquiries, from account management to troubleshooting. This has allowed Ally Bank to reduce its reliance on call centers, saving time and money.

Personalized Banking Services: Leveraging machine learning and natural language processing (NLP), AI chatbots can analyze customer data and provide tailored recommendations. They can offer personalized financial advice, spending insights, and product suggestions.

Wells Fargo’s banking assistant Fargo uses Google's Dialogflow conversational AI to help customers simplify their finances and get a holistic view of their financial health, while providing personalized experiences.

Improved Operational Efficiency: AI Chatbots automate repetitive tasks like balance inquiries, transaction history requests, and password resets. This speeds up processes and reduces the workload on human employees.

JP Morgan’s Chase Digital Assistant allows customers to check account balance, fetch account or routing numbers, pay bills, manage cards, and perform many other repetitive yet critical banking tasks.

Fraud Detection and Prevention: By monitoring transactions in real-time, AI chatbots can flag suspicious activities and instantly notify customers of any unusual transactions, helping banks prevent fraud. They can also alert customers immediately if any unusual activity is detected.

Bank of America’s Erica sends real-time alerts to customers about potential fraud, ensuring quick action can be taken to secure accounts.

Faster New Account Opening: Prospective customers are more likely to open a new account with a bank if they are greeted in a friendly, helpful manner and guided correctly. AI Chatbots can patiently guide them through account setup and documentation, while ensuring smooth customer experience and faster account creation.

Ally Bank’s in-app virtual assistant Ally Assist helps new customers open accounts and navigate the onboarding process, making it quick and hassle-free.

Seamless Integration with Digital Platforms: AI chatbots can be integrated into mobile apps, websites, and even social media platforms to provide a seamless omnichannel experience for customers.

Most virtual assistants, banking assistants, and chatbots have integrations to their respective bank’s mobile apps and websites. For example: Bank of America’s Erica and JP Morgan’s Chase Digital Assistant.

Multilingual Support: Banks can support a diverse customer base using AI chatbots capable of communicating in multiple languages. This is particularly beneficial for global banks or those serving multicultural communities

Many banks, including Bank of America and Wells Fargo, offer multilingual chatbot support to cater to their diverse customer base.

To find out how AI chatbots and virtual agents are changing how businesses operate across industries, check out our blog discussing the transformative impact of AI in business.

Want to Optimally Utilize AI Chatbot to Maximize ROI?

We can help you build an AI chatbot with the right features customized to resolve your unique technology and business challenges.

Benefits of Human Agents in Banking Customer Service

While AI chatbots offer many efficiencies in customer service, human agents remain essential for handling sensitive, complex aspects of banking support that require a personal touch, empathy, adaptability, and deep expertise. Here are some key reasons why human agents continue to play a critical role:

Empathy: Humans can offer genuine empathy, which is crucial in banking, where customers often deal with sensitive issues like frauds, financial difficulties, or complex transactions. They can empathize with a frustrated customer or offer reassurance during a challenging situation.

Adaptability and Problem-Solving: When customers encounter unusual issues like handling an unexpected error, human agents use their judgment and flexibility to find tailored solutions.

Handling Complex and Sensitive Issues: A human touch is necessary in complex or sensitive situations. For instance, when customers need guidance navigating financial challenges, they often require personalized advice from an experienced person.

Finding the Optimal Combination of AI Chatbots and Human Agents in Banking

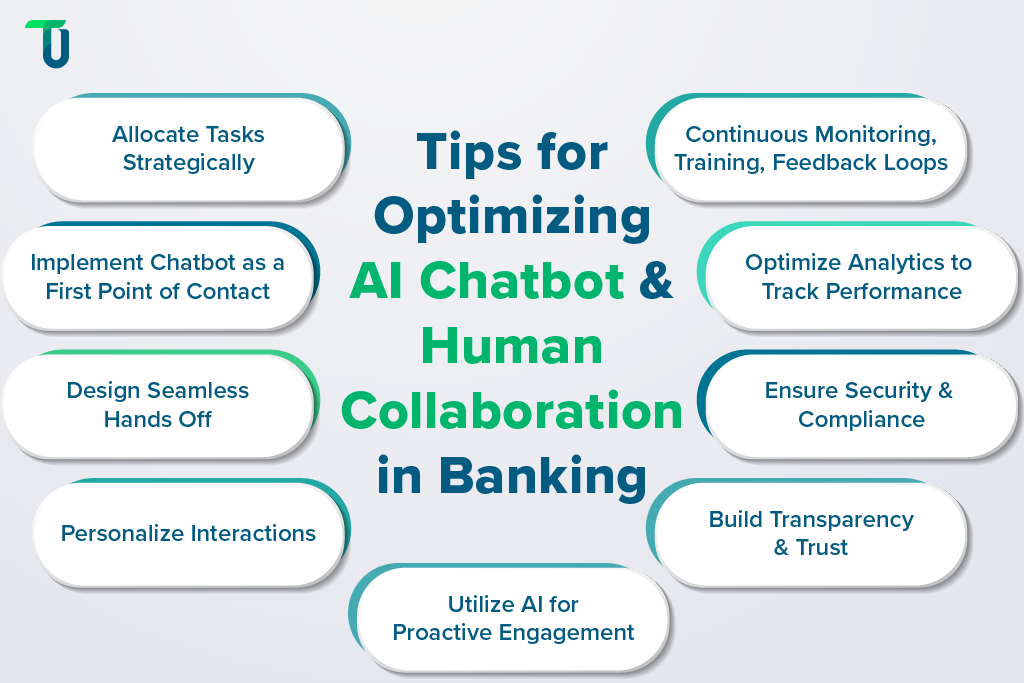

As AI chatbots continue to grow in popularity within the banking industry, finding the right combination of conversational AI and human agents is key to optimizing customer service and achieving the best ROI. Banks can improve efficiency, reduce costs, and enhance the overall customer experience by strategically integrating chatbots with human agents. Here are some practical tips to remember when building an AI chatbot and aiming to strike the right balance with human agents:

Allocate Tasks Strategically: Make the AI chatbot handle repetitive, low-complexity tasks that consume a lot of time for human agents. This includes answering account inquiries, providing balance updates, processing transactions, or guiding customers through a login or account opening process. With chatbots managing these tasks, human agents can focus on more complex and high-value interactions, such as handling loans, mortgages, and fraud-related issues. By allocating tasks strategically, you can ensure optimal and efficient utilization of both AI chatbot and human resources, leading to cost savings and faster response times.

Implement Chatbot as a First Point of Contact: Make your AI chatbot act as a 24/7 entry point for customers looking for assistance. The chatbot can help customers quickly with basic queries, direct them to the right departments, and even collect initial data before human agents get involved. This allows human agents to handle only the cases that require their expertise, ensuring that they’re spending their time on more complex issues that truly need human intervention.

Design Seamless Hands Off: When combining the strengths of AI chatbots and human agents, ensure a smooth handoff from the chatbot to the human agent. When a customer’s inquiry surpasses the chatbot’s capabilities, it should immediately offer an option to transition to a human agent. This handoff should feel natural and seamless, with the chatbot providing context so the human agent can pick up where the bot left off without the customers needing to repeat themselves. This not only saves time but also ensures customers feel heard and valued, which is critical in maintaining satisfaction and trust.

Personalize Interactions: While chatbots are often perceived as impersonal, train your AI model to offer highly personalized interactions by leveraging customer data. Integrate chatbots with customer relationship management (CRM) systems, to make AI greet customers by name, remember past interactions, and provide tailored product recommendations. Use AI chatbots effectively to enhance the customer experience, making it feel more personalized and efficient, all while freeing up human agents to focus on higher-level tasks.

Utilize AI for Proactive Engagement: Rather than waiting for customers to reach out with questions, use AI chatbot to engage customers proactively. For instance, make your chatbot send reminders about upcoming bill payments, provide information about new services, or notify customers of any changes in banking policies. Proactive communication can enhance customer experience by providing relevant information before issues arise, increasing overall customer satisfaction and reducing future inquiries to human agents.

Continuous Monitoring, Training and Feedback Loops: Fine-tune your chatbot so that it stays effective and aligned with customer expectations. Make the AI model (LLM) learn from previous customer interactions by implementing LLM evaluation and observability. Also collect feedback from human agents and customers in areas where the bot struggles or where customers frequently need to escalate to a human. Maintaining this feedback loop and continuously training the AI model enables it to handle more complex queries over time. This will further reduce your reliance on costly human support and optimize your ROI.

Optimize Analytics to Track Performance: To continually improve the balance between AI and human interaction, it’s essential to use analytics to track performance. By monitoring key metrics such as response time, customer satisfaction, and issue resolution rates, banks can identify bottlenecks or areas where the handoff between AI and humans can be improved or where chatbot responses can be refined.

Simultaneously, address cultural barriers to digital transformation by training the human agents to utilize AI-driven insights and other features of AI optimally to improve their efficiency and performance. This data-driven approach ensures that both chatbots and human agents are working in tandem to deliver the best possible service.

Ensure Security and Compliance: Banks must ensure a high level of security and compliance at all times as they deal with the customers’ sensitive personal finance data. Design your AI chatbot to meet banking regulations and adhere to strict security standards with federated identity management. Safeguard customer information and build trust by implementing robust encryption methods, secure authentication protocols, and ensuring data privacy.

Build Transparency and Trust: Make it clear to customers when they are interacting with a chatbot versus a human agent. Transparency helps set proper expectations and creates a sense of security in the service. Additionally, ensure the chatbot delivers accurate and helpful responses, allowing customers to feel confident in its assistance. Empower your customers by offering them the choice to transition to a human agent when needed. Adapt your service delivery based on your customers preferences to enhance their overall experience.

Key Takeaways: Future-ready Banking Customer Service with AI Chatbot Development

We’ve already discussed the benefits of utilizing both AI chatbots and human agents in banking customer service as well as discussed how to strike the right balance. This brings us to the the most critical part- developing the right AI chatbot that aligns with the unique needs of your bank. Ever wondered, why only the big banks are optimally utilizing AI chatbots? Because the skill gaps in AI make building tech team having skilled and experienced developers in AI, ML, and NLP difficult. And so, the easier way is to partner with tech companies specializing in AI development.

At TenUp, we have a team of highly skilled and certified AI developers and solutions architects focused on making AI more accessible and affordable while solving the real problems of financial institutions. Check out our comprehensive AI development services to understand how we can help you. You could also take a look at our success story, where we built an AI chatbot to solve the issues of our client in the recruitment industry.

Need help in building an AI chatbot?

Leverage our expertise and experience in building conversational AI solutions tailored to the specific needs of our customers.

Frequently asked questions

What is an AI chatbot, and how is it utilized in the banking industry?

An AI chatbot for banks is an AI-powered virtual assistant that automates customer interactions using natural language processing (NLP). Banks use AI chatbots to provide 24/7 customer support, answer account-related queries, assist with transactions, detect fraud, and offer personalized financial insights. By improving efficiency and reducing wait times, AI chatbots enhance customer experience while cutting operational costs.

Will AI chatbots replace human agents in banks?

No, AI chatbots will not replace human agents in banks but will complement them. Chatbots handle routine queries, automate transactions, and provide instant support, freeing up human agents to focus on complex issues. Additionally, AI assists human agents by providing real-time data and automating repetitive tasks.

How is AI impacting customer service?

AI is transforming customer service by enabling fast, efficient, and personalized support. AI-powered chatbots and virtual assistants automate routine inquiries, reduce wait times, and provide round-the-clock assistance. Advanced AI tools enhance workflows, assist human agents with real-time insights, and improve issue resolution. By streamlining operations and reducing costs, AI helps businesses deliver seamless and scalable customer experiences.

What is the dilemma between human vs AI customer support?

The dilemma lies in balancing efficiency and personalization. AI customer support offers speed, automation, and 24/7 availability, but lacks human empathy and complex problem-solving. Human agents provide personalized assistance and emotional intelligence but are limited by time and cost. The ideal solution is a hybrid approach, where AI handles routine tasks while human agents manage complex issues, ensuring a seamless and efficient customer experience.